Power Hungry? Supplement the Grid with Distributed Energy Resources

Power demand is surging — putting to the test an already constrained and aging grid.

Data centers, transportation electrification, and new manufacturing facilities are gobbling up increasingly large quantities of power. Yet demand can grow only as fast as the slow-to-modernize grid expands.

Facing long delays for utility upgrades, power-hungry energy users are competing for available supplies. The imbalance between future demand and forecasted supply poses significant risks to major construction projects, driving up project costs and threatening delays that can last months or years.

Amid this uncertainty, more energy users are expected to take advantage of on-site generation and storage. “Distributed energy resources” present potential as rapidly deployable solutions, offering reliable, resilient, affordable power.

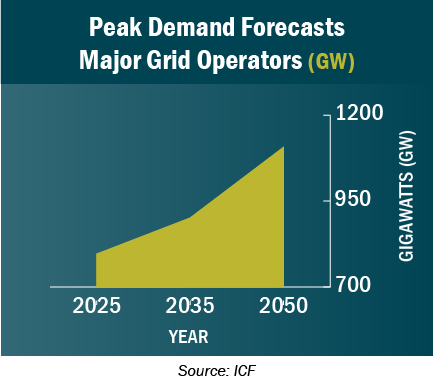

Unprecedented electricity demand growth

Over the past decade, annual electricity demand grew at a rate of less than 1 percent. Recent load growth expectations have changed dramatically. Forecasts suggest a whopping 2-5-percent annual growth in peak demand, on average, across the country’s grid planning areas.

Several trends are fueling this unprecedented growth in electricity demand:

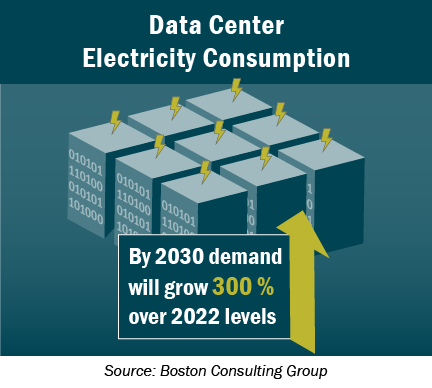

- Data centers are expanding in size and number as demand for computer power accelerates to support artificial intelligence, cloud computing, and cryptocurrency

- Federal and state industrial economic policies are incentivizing a burst of private investment in advanced manufacturing plants and other large industrial facilities

- Transportation electrification is replacing personal vehicles and fleets with battery-electric alternatives

- Building heating systems are transitioning to fully electric air-sourced or ground-sourced heat pumps, variable refrigerant flow systems, and heat recovery chillers

- Emerging technologies are electrifying large-scale industrial facilities such as steel plants, glass manufacturers, and paper mills

- Climate change is increasing peak summer temperatures, driving greater cooling demand

In Texas, for example, peak load reached 69.5 GW in 2018. Today, the state’s data centers alone demand more than 2 GW. Forecasters expect 1 million electric vehicles across Texas in the next five years. It’ll all add up — the Electric Reliability Council of Texas (ERCOT) anticipates 2035 peak demand will reach 150 GW.

Generation, Transmission and Distribution Challenges

Electric generation, transmission, and electric distribution infrastructure are not keeping pace with the surge in demand. Building out new infrastructure takes time and comes with considerable cost. To interconnect with the grid, utility customers with large loads are frequently told to wait three years or more. Several factors contribute to these delays.

Generation

Large-scale wind, solar and battery energy storage are now faster and cheaper to build than ever before. Thousands of large-scale renewable energy and battery storage projects are waiting to come online. System operators have been slow to approve this backlog — largely due to bottlenecks created by inadequate transmission and distribution infrastructure.

Transmission

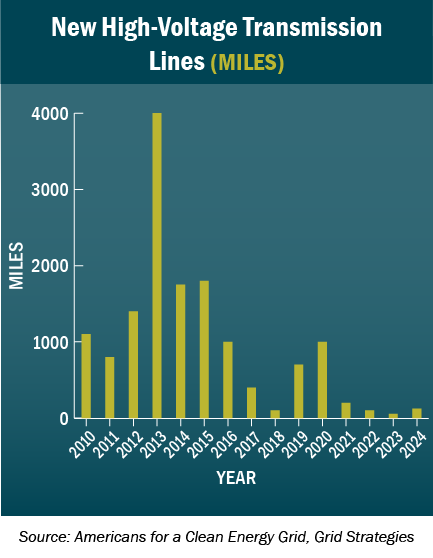

U.S. grid operators rely on roughly 240,000 miles of high-voltage transmission capacity. Think of it like the interstate highway of the power grid. To meet growing demand and to fulfill climate goals, federal estimates suggest regional transmission capacity will need to double. Yet growth of new transmission lines has fallen from an average of 1,700 miles built per year in the early 2010s to 350 miles built per year in the early 2020s. Transmission lines take years if not decades to complete. Permitting, land acquisition, and other construction challenges add significant delays — often holding up projects indefinitely.

Distribution

Utilities are dedicating greater resources to expanding and improving the distribution system, the backroads of the power grid. Total spending has increased by 64 percent over the past two decades. Industry forecasts suggest investments will reach $420-$580 billion through the end of the decade. But costs and delays are rising as utilities face challenges sourcing transformers and other distribution equipment. Transformer supply chain lead times are up to two years — driven by manufacturers’ material, equipment, and labor constraints.

Distributed Energy Resource Solutions

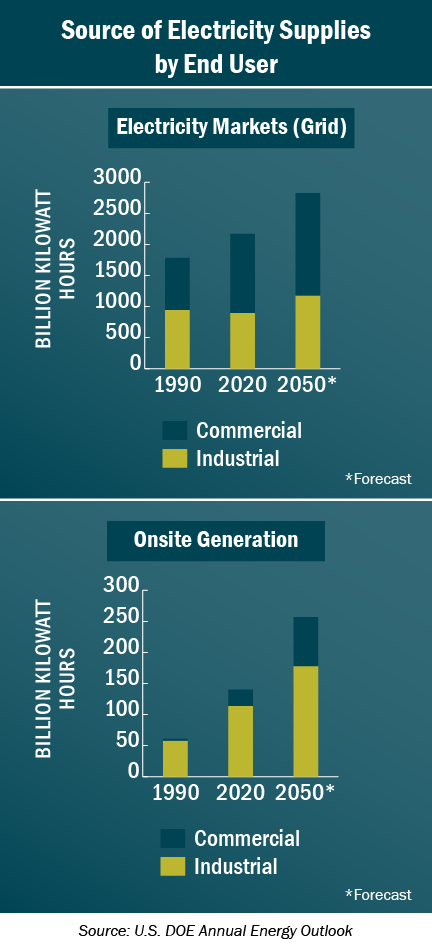

An emerging solution is the construction of on-site power generation and storage. So-called distributed energy resources (DERs) include technologies such as solar photovoltaics (PV), fuel cells, and large lithium-ion batteries. Federal forecasts envision on-site power generation will double by 2050, accounting for more than 7 percent of total electricity generation. If current trends continue, however, this outlook will likely be a significant underestimate.

DERs present an alternative to adding utility feeds or other grid expansion projects. As “non-wire alternatives,” DERs can supplement grid connections or serve as short-term power sources while awaiting the grid interconnection process. DERs are scalable, modular, flexible solutions that can be phased to responsively match a facility’s power demand growth.

Going an extra step, energy users can integrate DERs through an advanced microgrid. Installing microgrids allow facilities to switch to “island mode” in the event of a utility outage, seamlessly separating from the grid without power interruptions. Microgrids also enable greater flexibility: energy users can scale power supply to match loads, participate in utility demand response or load shifting programs, and adjust power consumption to take advantage of energy market prices.

DER costs continue to fall, particularly for solar PV and batteries. Meanwhile, federal tax incentives, state grant programs, and utility rebates are lowering the upfront cost for on-site DERs and microgrids. Read: Inflation Reduction Act Brings Clean Energy Within Reach

Control Operational Destiny Amid an Uncertain Energy Future

Projected growth in power demand is shaping up to be unlike anything the economy has experienced in decades. Put simply, the grid is unprepared.

Among the consequences, energy users will face even greater competition for limited power supplies. For local utilities without excess capacity, expanding transmission and distribution infrastructure will take a considerable amount of time. Infrastructure costs are likely to grow — with much of the burden falling upon energy consumers and ratepayers.

Before committing the time and cost to build out large grid infrastructure projects, energy users should first turn to DERs and microgrids. This is especially true when operating facilities located in regions prone to grid outages and rising electricity costs. Installing on-site power generation and storage can, in many instances, be the lower-cost option while greatly improving a project’s speed to market.

The country’s energy transition brings uncertainty. Choosing to build on-site power and storage supplies can provide energy users with greater control over their future, offering stability and resilience for years to come.