Electric Bus Owners Charge Up with New Service Models

Electric vehicles present a once-in-a-generation opportunity to reimagine how transit agencies manage their bus fleets.

As costs fall and performance improves, the number of public electric fleets is expected to multiply tenfold in the years ahead.

Charging battery-electric vehicles will not be simple. The transition will require navigating through unprecedented financial, technical and logistical considerations.

Rising to the challenge, a market for fleet-charging services is taking shape. Fleet electrification creates opportunities for service providers who can efficiently and cost effectively install, operate, monitor and maintain charging equipment and related infrastructure.

Greater understanding of these newly emerging business and financing models will ultimately lead to a faster, more widespread and cost-effective transition toward an electrified transportation future.

Smart Charging Meets the Smart Grid

Today, battery electric buses account for less than 5 percent of U.S. public transit agency fleets.

By 2040, EVs are predicted to represent 65 percent of the global bus fleet, according to Bloomberg New Energy Finance.

Such a large-scale, rapid transition will require a quick adjustment to the hardware, software, power supplies and electrical infrastructure that make fleet electrification possible.

Transition plans must take into account various factors influencing total cost of operation. Beyond choices in vehicles, fleet program considerations include:

- Charging infrastructure quantity, power level, location and interoperability.

- Fleet operation schedules, route distance, weather conditions and downtime.

- Energy supply and peak demand charges.

- Fleet facility power capacity, space availability and structural-support systems.

- Grid power capacity, power reliability, distributed energy potential, and interconnection requirements for battery storage, renewable energy, or vehicle-to-grid (V2G) services.

To simplify the process, “Charge Management Solution” providers are ready to step in.

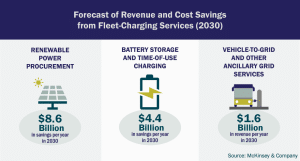

An estimated $11 billion capital investment is needed to meet U.S. demand for fleet charging infrastructure by 2030.

Centralized software-as-a-service (SaaS) solutions can automatically charge EVs at optimal levels during ideal schedules. Various providers can maximize operational efficiency based upon route logistics, vehicle maintenance needs and charging station availability.

Energy management challenges involve careful review of electrical capacity, observing consumption and peak-load operations, while planning for any potential infrastructure upgrades.

In response, energy management systems have been adapted for fleet operations. Commonly used by large facilities to track building energy use and to manage electricity costs, charging system operators can likewise monitor electricity usage to optimize when charging takes place, aligning schedules with power prices.

Turnkey Charging Solutions

Service providers are positioning themselves to best manage risks involved with EV fleet transitions, consolidating multiple services into simplified, turnkey solutions.

Charging as a Solution (CaaS) or electric vehicle fleet-as-a-service (eFaaS) solutions are subscription models where service providers offer fleet operators or property owners use of their charging stations, as well as back-end software, charger maintenance and necessary electrical hardware upgrades.

These solutions can include energy management services, integrating smart charging within the CaaS software or storing grid power when prices are low. Charging costs can be significant if power draw is not spread out and timed to avoid high peak demand charges. Services can also include procuring the lowest-cost electricity available on retail markets.

In New York City, for instance, the Metropolitan Transportation Authority entrusted manufacturer New Flyer to develop a charging system design and energy management plan for the M42 route pilot passing through Times Square.

“Bus Plan: Double-Decker and Electric Buses”, by Marc A. Hermann / MTA New York City Transit, licensed under CC by 2.0.

Additional early-stage technology platforms offer V2G capabilities. Through bi-directional charging, fleet operators can choose to sell energy back to the grid. Platforms can delay charging or charge EVs more slowly. This allows fleet owners to contribute small amounts of electricity back to the grid at times of short energy supply.

In situations where fleet owners choose to produce some power onsite, an increasing number of renewable and energy service providers offer EV fleet power or storage system design and installation. Solar energy developers, solar carport providers, utility companies and wholesale generators are exploring opportunities to participate.

Financing Models

Fleet procurement strategies are typically designed to accomplish one-for-one replacements of older vehicles with newer models. This approach, however, often fails to consider the upfront cost of new charging infrastructure or the additional risks and uncertainties of new vehicle technology.

To overcome these financial hurdles, some charging service providers are including financing tools in their packages.

Under an operational expense financing model, certain CaaS subscriptions require no up-front costs. Charging infrastructure is paid for out of the fleet owner’s operating budget rather than capital expenditures.

Bus manufacturer Proterra is decoupling the cost of batteries from the sale of their vehicles. Public transit customers can purchase a battery electric bus and lease the batteries over the vehicle’s lifetime. If the batteries are leased under a guaranteed performance contract, Proterra assumes operation risk and allows transit agencies to hedge against future replacement battery costs. Battery lease programs are today deployed by Utah’s Park City Transit and Illinois’s MetroLINK.

Other transit agencies are seeking public-private partnerships that shift even further risk on charging service providers. Similar to the Power Purchase Agreement popularized by solar energy developers, transit agencies are agreeing to set costs on a price-per-mile-driven model.

In 2020, Anaheim Transportation Network was the first to announce a per-mile-driven Charging as a Service contract.

In 2020, Anaheim Transportation Network (ATN) was the first to announce a 20-year, per-mile-driven CaaS contract that involved charging system infrastructure design, procurement, installation, operation and maintenance. ATN estimates deployment of a 46-bus fleet, powered in part by a 545-kW solar canopy, will save the agency $4.8 million in fuel costs over the contract.

Charging service providers are able to minimize costs by aggregating multiple energy supply contracts. In addition to locking down long-term competitive rates, charging providers are maximizing other incentive programs to drive down installation costs.

Charging Ahead

As more fleet vehicles are upgraded to EVs, the role of charging service providers will become increasingly important.

California already requires the state’s transit agencies procure EV vehicles. Other states are likely to roll out similar mandates in the years ahead. With federal or state funds unlikely to cover the full cost of new vehicles and infrastructure installation, public-private partnerships will take on greater importance — whether with utilities, manufacturers, CaaS providers or other third parties.

As more fleet vehicles are upgraded to EVs, the role of charging service providers will become increasingly important.

Widespread adoption of EVs will require new financing approaches. Innovation may take the form of green bonds, on-bill financing — where utilities act as lenders — or some approach that has yet to materialize.

Given the novelty of EV technology, charging solutions and financing models, fleet operators should proceed cautiously. Planned appropriately, barriers to fleet electrification can be overcome and the benefits can multiply, leading to lower operating costs, cleaner air and a greener reputation.